when are property taxes due in will county illinois

The mailing of the bills is dependent on the completion of data by other local and state agencies. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500.

Sales Tax Information Bureau County Government Princeton Il

Conducts annual sale of delinquent real.

. Subsequent taxes will only be accepted in office Monday Friday 830am 330pm. Because of the delays we believe the second-installments property tax bills will be issued late 2022 or the first part of 2023. Tax amount varies by county.

Will county illinois property tax due dates 2021. Illinois was home to the nations second-highest property taxes in 2021. What is property tax.

At the annual tax sale individuals bid on the right to pay the delinquent taxes and penalties and then charge the property owner interest at an initial maximum rate of 18. This means that you. If this happens it is possible that second-installment.

Will County Property Tax Due Dates 2022. Half of the First Installment is due by June 3 2021. The remaining half of the First Installment is due by August 3 2021.

Will County collects on average 205 of a propertys assessed fair market. The first installment of property tax bills in 2023 is expected to be due March 1. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

407 N Monroe Marion IL 62959 Phone. M-F 800am - 400pm. In most counties property taxes are paid in two.

The grace period for paying property taxes in Illinois is 30 days. The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Will County property tax due dates 2021.

Welcome to Property Taxes and Fees. Billing and Collection of nearly 66 million real estate taxes. The remaining half of the First Installment is due by August 3 2021.

In a state with the 2nd highest property taxes in the country some are concerned that mandates in the SAFE-T Act will force tax hikes around Illinois. When summed up the property tax burden. The interest on the installment due June 1 2022 will accrue on June 2 2022 at 45 per month payable in installments.

The city and every other in-county public taxing district can now compute needed tax rates because market value totals have been recorded. Lake County IL 18. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet.

Heres what you need to know about the grace period for paying property taxes in Illinois. 1 day agoTo be eligible you must have paid Illinois property taxes in 2021 on your primary residence and your adjust gross income must be 500000 or less if filing jointly. 1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted.

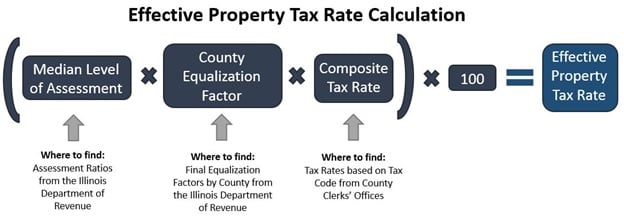

Property tax is a local tax on real estate land buildings and permanent fixtures that is imposed by local taxing districts and is based on a propertys value. Due dates will be as follows. 2 nd Installment due September 1 2022.

Assists the County Board in formulating budgets financial plans and projections. When this office receives that data we will be able to print and mail the bills. 173 of home value.

Property Tax Burden In The Chicago Region Cmap

Six Places Chicagoans Will Flee To If Property Tax Increases Are Part Of Chicago S Pension Fix

Will County Gives You More Time To Pay Property Taxes Joliet Il Patch

.png)

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Please Will County Supervisor Of Assessments Facebook

Will County Il Elections Will County Il Elections

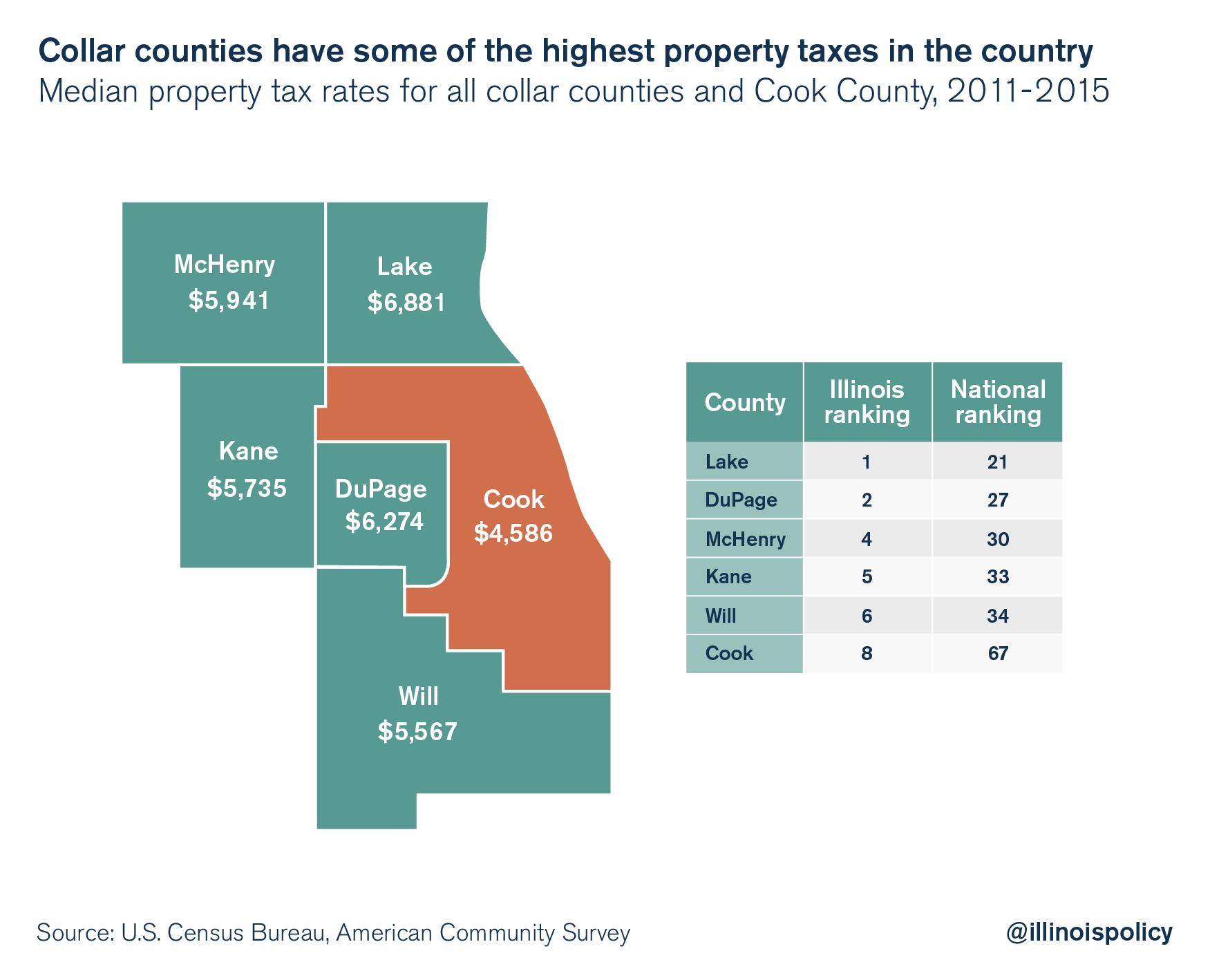

Homeowners In Collar Counties Pay Highest Property Taxes In Illinois

Will County Il Elections Will County Il Elections

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Will County Property Tax Notices Arrive 2 Months Late

New Will County Property Tax System Allows Homeowners To Escrow Taxes Without A Bank Joliet Il Patch

Your Assessment Notice And Tax Bill Cook County Assessor S Office

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

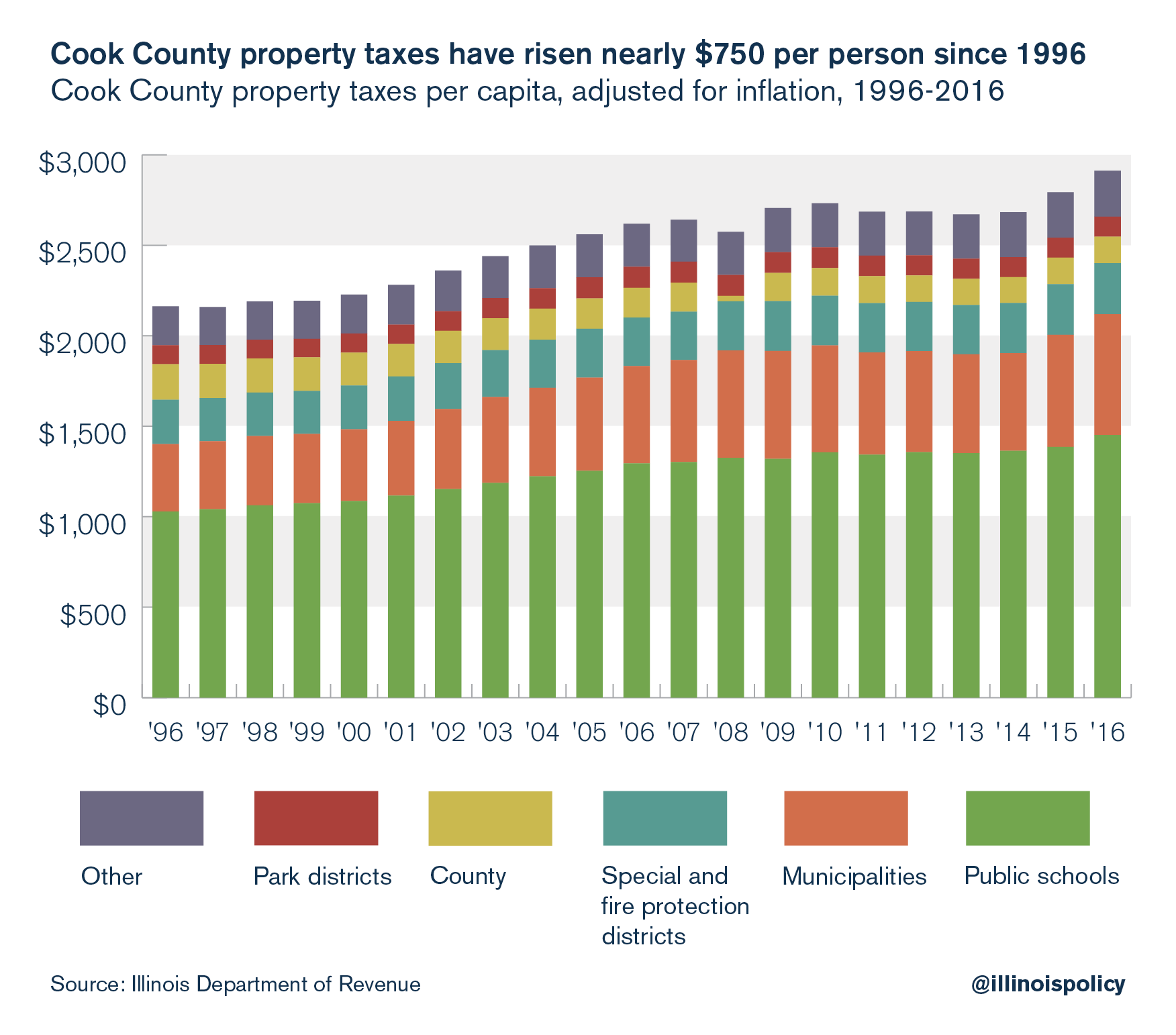

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy